Tokenize your assets on top of our infrastructure

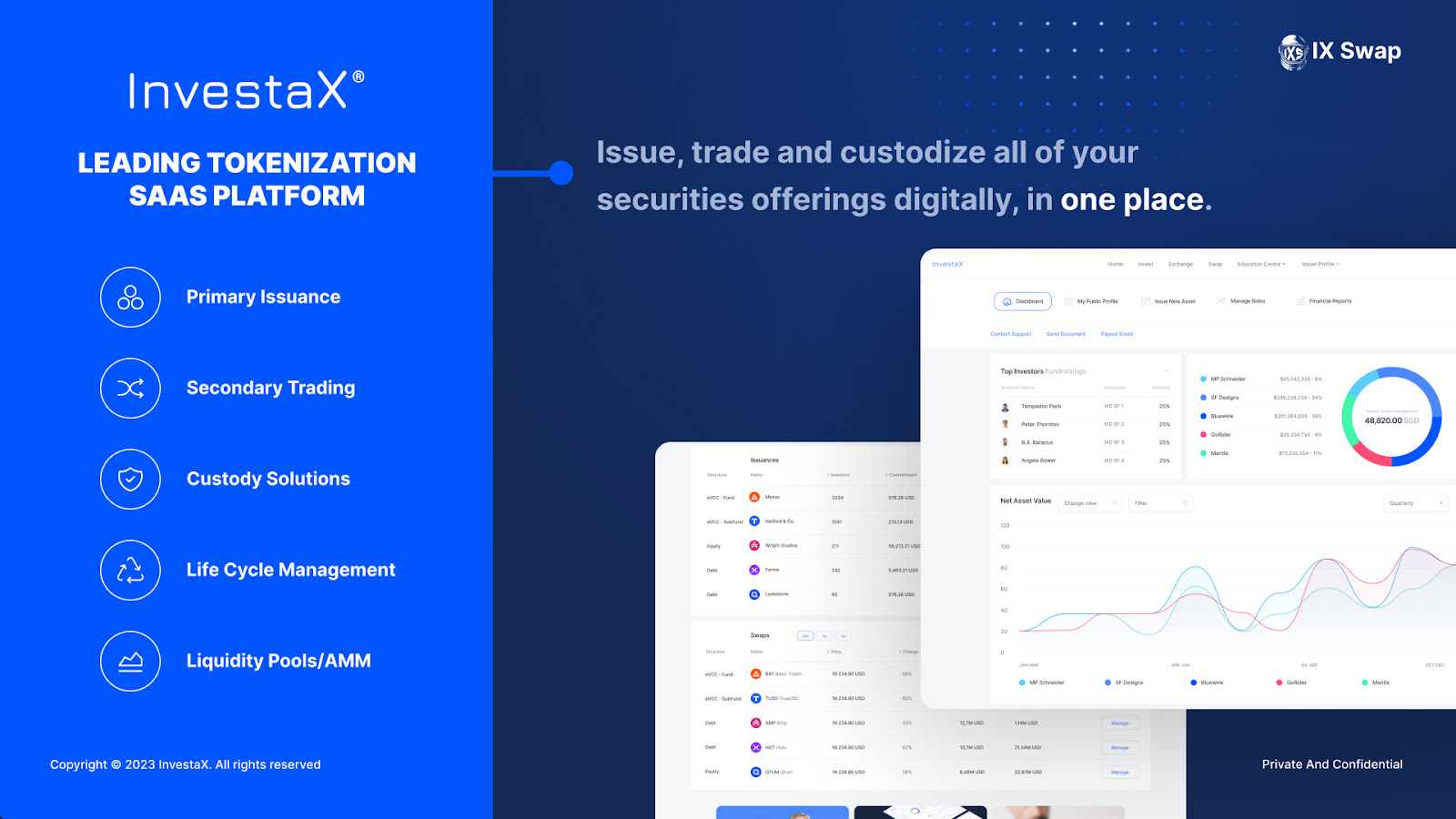

Our Tokenization SaaS platform is a software-as-a-service solution that enables the issuance, trading, and custody of security tokens for private market assets. We have been granted a Capital Markets Services and Recognized Market Operator licence by the Monetary Authority of Singapore to deal in and operate an organised market for security tokens respectively. Our service offers a one-stop solution for all your security token needs, including seamless banking integration, thorough user verification with a KYC module, flexible OTC trading options, primary issuance services, cutting-edge blockchain technology, and smart contract deployment.

We believe that the transformative forces of tokenization will lead to the largest paradigm shift in the history of the $13T USD global private markets. When looking back at the development of the capital markets, every significant expansion of the public capital markets can be attributed to the introduction of new technology or the development of new process. 1801 was a significant year as that’s when the London Stock Exchange was created and marked the beginning of the dedicated marketplace to trade stocks. Volume and trading was low, but as new technology and practices developed so did the size of the public markets. Take examples such as electronic trading first created on venues like Nasdaq, or new investment structures like ETFs, and inventions like the ticker tape increased efficiency and trading and led to the development of clearing firms, transfer agents and 3rd party ledgers like a central depository (e.g. DTCC). It is clear that technology runs the financial system today.

Tokenization brings some obvious benefits of digitization, but greater value lies in taking one dimensional assets like a share of a startup or real estate fund, and making them multidimensional. Tokenization opens up a whole new world of possibilities for private market investments. By converting assets into digital tokens, they can be easily traded on blockchain-based platforms, providing greater liquidity and accessibility to a wider range of investors. Tokenization also enables fractional ownership, allowing investors to buy and sell small portions of an asset, rather than having to purchase the entire asset.

Tokenization brings multi-dimensional use to assets because technology is the investment structure itself, not paper, so you now have programmable investment structures paving the way for a world of new investment products and use cases. Additionally, being able to lend, borrow, stake or create liquidity pools with your tokenized assets will open a whole new world of investment opportunities.

We believe eventually, all funds and investment vehicles will be issued as tokens, which we will call security tokens or STOs for the remainder of this article. It is just a better format regardless of which participant in the investment transaction you are.

The STO market was born in 2018. Since then, there has been significant growth and progress around the world. However, until recently there has only been 2 models available for an investment firm that would like to issue an STO.

The first model is called token issuance and it is a pure service offering with the value proposition being that an asset owner can use the token issuance company, a technology only company, to issue the STO on behalf of the owner. This was the first model in the industry and provided some value, however, as STOs are securities, most investment firms are looking for additional licensed services needed in the issuance and trading of a security such as broker-dealers, exchanges or custodians (note these all require financial licenses and are regulated activities for STOs). Token issuance alone is not the end game.

The second model we call the security token exchange model, and it brings the technology and necessary licenses to facilitate the life cycle management of issuing and trading an STO. Think of this model as a “tokenized version” of the traditional stock exchange, where there are lots of services and fees, and asset owners must send their assets and their investors to the exchange. Many STO exchanges are also built on private blockchains and are disconnected from the entire ecosystem of digital currencies, cryptocurrencies and other innovations from the Decentralized Finance industry, which all use public blockchains. This model adds value but again is not the end game.

The third model, and in our opinion, the far superior model, is “Licensed” Tokenization SaaS (Software as a Service). You reap the benefits of both of the above models “token issuance” and “security token exchange”, without the disadvantages. Additionally you receive the added features of customization and control over your assets and investors, this is key. You can utilize broker-dealer, OTC and exchange services without needing licenses of your own. It is the best of both worlds and the end game from a market solution perspective.

Our Tokenization SaaS platform is a software-as-a-service solution that enables the issuance, trading, and custody of security tokens for private market assets. Our service offers a one-stop solution for all your security token needs, including seamless banking integration, thorough user verification with a KYC module, flexible OTC trading options, primary issuance services, cutting-edge blockchain technology, and smart contract deployment.

Benefits of Using our Tokenization SaaS Platform:

All-inclusive one-stop-shop solution: Tokenization SaaS platforms offer everything an investment firm needs to get started with tokenization, including issuance, trading, and custody solutions.

Latest blockchain technologies: Tokenization SaaS platforms use the latest blockchain technologies to ensure the security and integrity of tokenized assets and a choice of blockchains as well.

Fast integration time: Tokenization SaaS platforms are designed to be easy to integrate and onboard, allowing investment firms to get started immediately.

Low cost: Tokenization SaaS platforms offer the most cost-effective solution.

Additionally, InvestaX has been granted a Capital Markets Services and Recognized Market Operator license by the Monetary Authority of Singapore, which allows them to legally deal in and operate an organized market for security tokens. InvestaX also has a user-friendly tokenization SaaS platform that makes it easy for investment firms to get started with tokenization, customize the platform and their offerings and stay ahead of the curve in the world of private market investments. You can read more about our competitive advantage here.

At InvestaX, we offer the leading Singapore Licensed Tokenization Service-as-a-Software (SaaS) platform for Real World Asset Tokens (RWA) and Security Token Offerings (STO). We provide a one stop shop for tokenized assets for global investors, including real estate, private equity, venture, ESG, startup, private credit/debt and more. We also provide IX Swap, the first legal and compliant Automated Market Maker (AMM) for RWA and STO.

If you are interested to learn more about how you can build your business on top of our infrastructure and what we can offer you as your tokenization partner, then contact us here. Thank you.